The Portfolio Letter

History, economics, psychology and markets | Portfolio report #1 / November 2025

I have decided to introduce a new investment portfolio newsletter to the Total System Freedom publication and this will be the first issue.

This new newsletter will accompany the previous system focussed newsletters. They will together encompass and integrate the larger goal of maximising personal freedom in our lives.

As a voracious consumer of paid investment research and having experienced the financial benefits alongside the knowledge and wisdom gained, I see it as the next logical step to publish my own investment newsletter. Although I am still an amateur investor, my current year to date returns could be seen as very good when compared to traditional portfolio return benchmarks.

In these newsletters I will transparently share my current portfolio, new trade ideas, my thoughts on the markets, my macro investment theses, relevant research and perhaps some thoughts about life and the state of the world in general.

As the world changes I believe authentic human generated content as opposed to AI generated content will become more valuable. I hope to embrace this change and play a role by attempting to create disciplined, valuable and fully realised content. Using my fingers to hit the keyboard, typing each letter.

If you are interested in protecting and growing your wealth, developing a macro thesis as it pertains to the financial markets and having a corresponding investment strategy is incredibly important right now.

My goal is to help people who are just starting on their journey, and to also cater to the more experienced investors who enjoy reading multiple financial newsletters to view and absorb diverse perspectives.

I hope you can follow along and learn from my wins and losses and my overall approach to investing, trading and the thought process that accompanies it.

This is not financial advice, I just will be showing you what I do in the hope that you can take away something positive and benefit from it.

Writing this letter will benefit me and hopefully you, as it will allow me to gain clarity and to test and crystallise my thoughts on economics, trades, and investing strategy via the medium of writing.

I will attempt to combine the trivium of grammar, logic and rhetoric to make sense of the world and markets. I will take action, position accordingly and ideally protect and grow my wealth into the future.

I will then share the process with the Total System Freedom community and readership for what I hope to be mutual benefit.

The Current Situation

I believe we are currently living through a once in a century phase of a cycle where capital preservation is currently more desirable than capital growth.

This cycle of societies rising and falling has been observed through history by authors William Strauss and Neil Howe in their book The Fourth Turning. Like a forest fire, societies do not progress endlessly, they go through a process of crisis and regeneration.

In each cycle of 80-100 years it is hypothesised that there are ‘four turnings’, each representing four different phases within the time period.

If we are to believe that these patterns will re-occur, we can observe that we are currently in the crisis phase of this cycle which is ‘The Fourth Turning’.

When it comes to your wealth, prioritising return ‘of’ capital rather than return ‘on’ may be the most prescient and financially wise strategy at the current moment.

Sure, there are great undervalued companies in global markets which you can buy outside of the S&P500 and this could be a good and profitable idea, but in a period where the monetary system is fundamentally changing and fiat currencies are failing to maintain purchasing power, the focus should be on protection.

But I will caveat this by saying the show can go on a lot longer. As long as people believe in shoving their money into the goliath that is the U.S stock market and as long as they have access to cash and credit that will allow them to do that, any sustained and prolonged crash in the markets may be delayed.

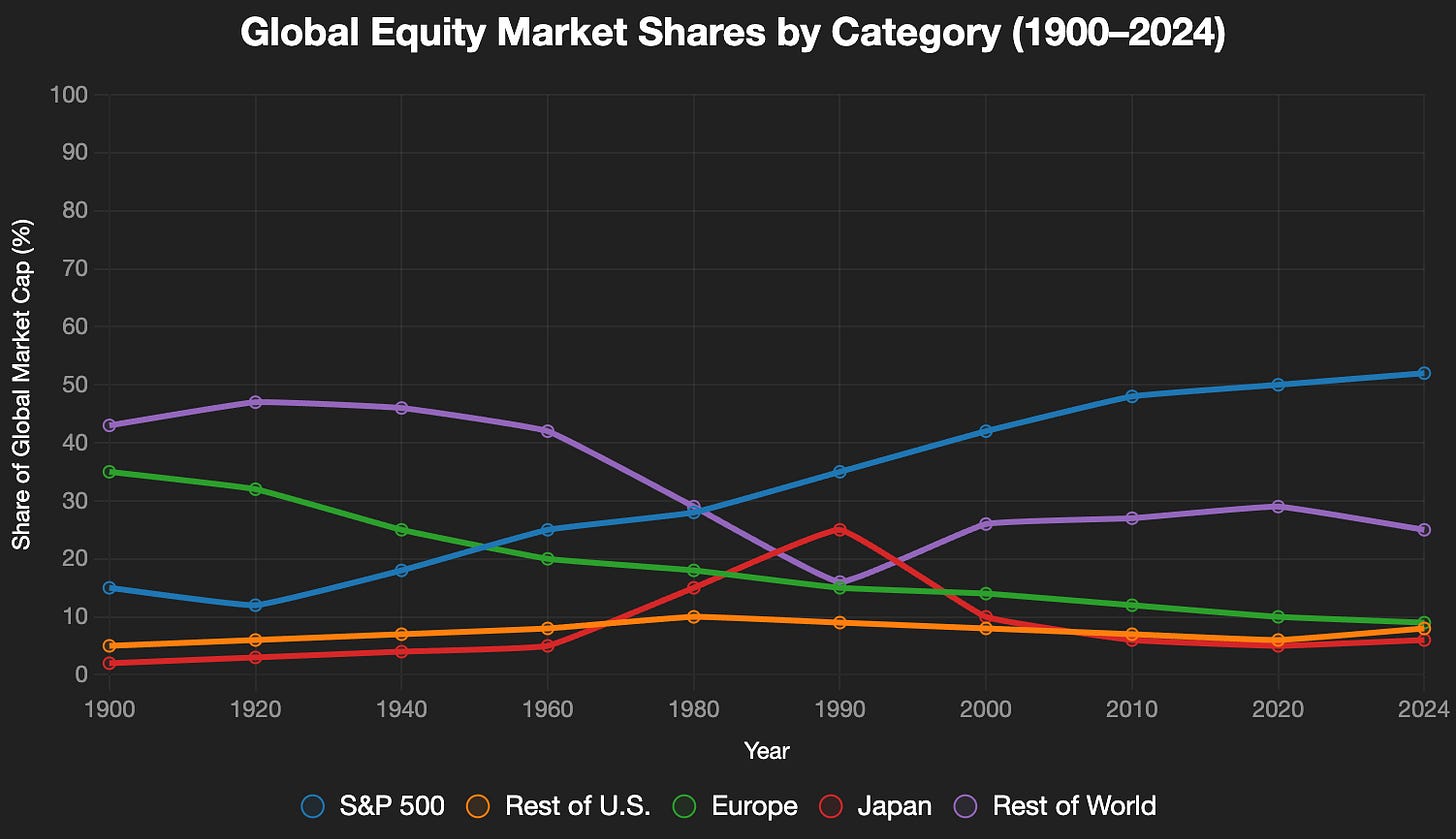

In the below chart you can observe that 52% of global equity market capital is invested in the S&P 500. Increased capital flows out of the S&P 500 could create a major capital rotation event.

Global Equity Market Breakdown (2024/2025)

│ S&P 500 ███████████ 52% │

│ Rest of U.S. ██ 8% │

│ Europe ███ 9% │

│ Japan ██ 6% │

│ Rest of World █████ 25% │

Public and private debt levels globally are the highest they have ever been which begs the question, how long can it keep rising before something breaks?

What happens when sovereign bond yields surge higher and keep going higher?

If this happens it would indicate a loss of faith in the stability of the purchasing power of the underlying currency and an increased risk that your invested capital from government bonds may be confiscated or defaulted on.

For example Russian owned U.S treasury bonds were stolen/seized by the U.S government in 2022. There is no reason why they wouldn’t do it to another country if they desire.

This is one reason why central banks have been steadily increasing their purchases of gold bullion in the last few years. As the risk of holding U.S treasury bonds has increased.

The greed in the fear and greed cycle is driving markets higher.

Technology companies and artificial intelligence related companies are the focus of what is being talked about in the mainstream media and this has led to bubble like valuations.

The price to earnings ratios of the magnificent seven stocks which have the highest weighting in the S&P 500 and Nasdaq 100 indexes have an average price to earnings ratio of 68.44, while comparatively companies in another sector like the Invesco S&P SmallCap Energy ETF have a weighted average P/E ratio of 11.51.

It is generally considered that a P/E ratio of under 10 indicates potential value.

The magnificent seven stocks are profitable companies and have made people a lot of money but do they currently deserve the valuations and market capitalisations they have? Or is this a result of having benefitted from passive investing flows, credit expansion and stock buybacks?

Large amounts of capital could rotate out of these U.S based stocks and into real money and value stocks quicker than you may realise and it is better to be prepared.

We are also currently in the midst of a profound change in the financial system and the way the world is structured.

The main change underway is the loss of purchasing power of global currencies due to consistent money supply inflation (money printing/quantitative easing), the resultant consumer price increases, increased public and private debt, weakening economies and the move away from using the U.S dollar in international trade.

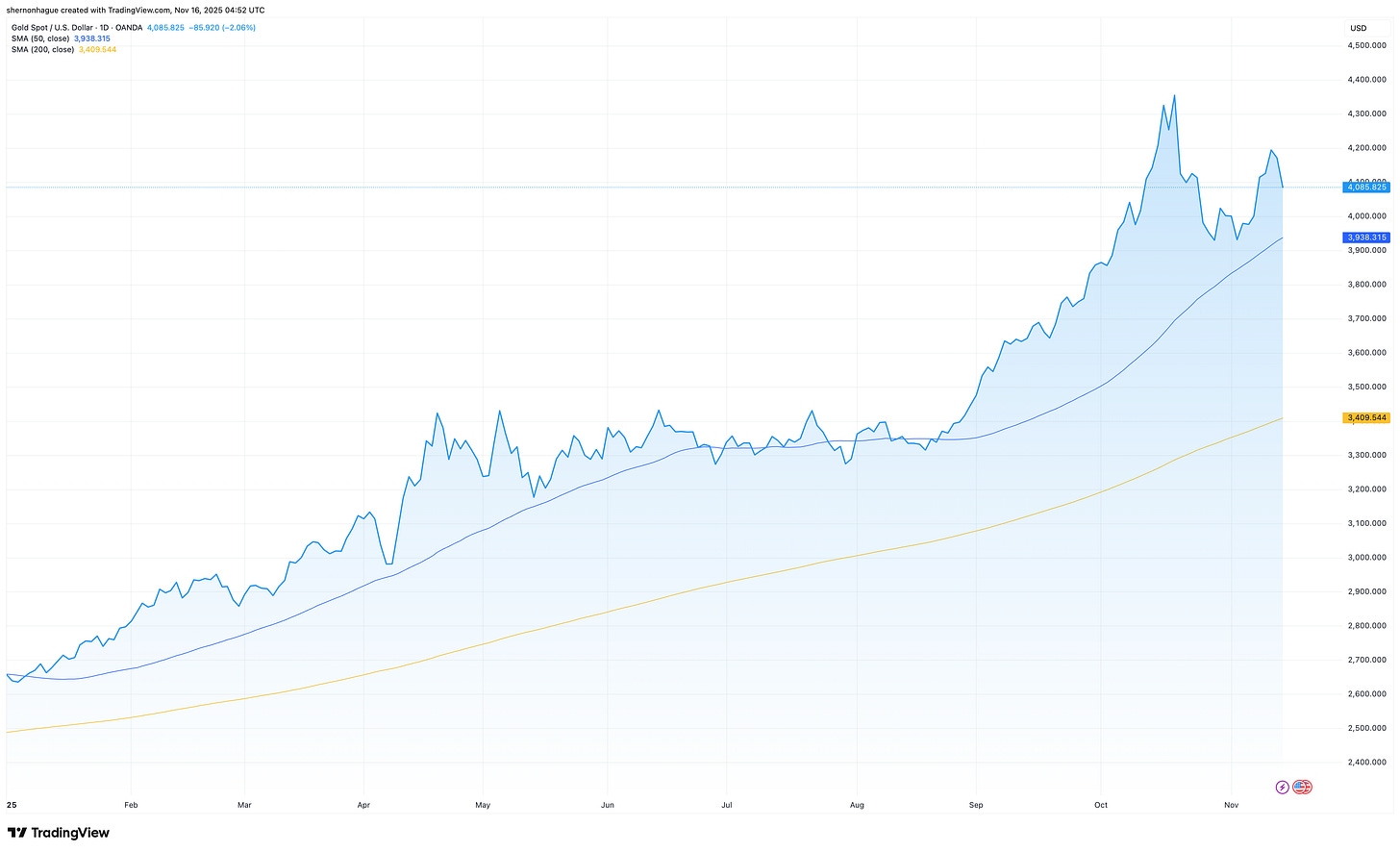

You can see this reflected in the price of gold, which has been the core money of financial systems for 5000 years.

A rising price of gold indicates falling fiat currencies, as it is the true risk free money which everything else is to be measured against.

The rules of the monetary system are currently being rewritten.

I personally see gold returning to its rightful throne and becoming the most desired money and pristine collateral to be used between counter-parties and in international trade.

Central banks have been accumulating record amounts of gold and China is taking to steps to build gold vaults in other countries to be used for seamless Yuan-gold conversions. Also for direct settlement in gold for international trade via the Shanghai Gold Exchange (SGE).

Currently a Chinese SGE offshore gold delivery vault in Hong Kong has been established and has been in operation since June, 2025.

If fiat currencies return to a gold backing the gold price would need to be much higher to back the gigantic fiat currency base which has inflated exponentially since 1971 when Richard Nixon took the U.S dollar off the gold standard.

So what do we do about it as investors? Well I can tell what I am doing and perhaps it could give you some ideas.

If the world is moving back towards gold and away from the U.S dollar I want to be long physical gold and silver, long quality gold and silver mining companies, and long quality equities in cheap, undervalued sectors in global markets that will eventually trend upwards and provide asymmetric returns.

I also believe there could be potential in companies that create an exciting, future focussed product and narrative in the technology space. Even if these companies have no revenue currently and present more risk as growth stocks.

An example of this would be the electric vertical take-off and landing (eVTOL) aircraft and humanoid robot sectors.

I have allocated my capital accordingly and will continue to take profits and rebalance my portfolio as needed.

Portfolio Construction

The percentage allocations to gold, silver, commodities, equities and fiat currency must be determined by the individual investor and their risk tolerance.

A general portfolio could consist of gold and silver bullion, real estate, equities, alternative investments and cash. It depends on many factors and your risk tolerance. How much riskier investments are you willing to take on to increase your returns?

Considering these asset classes could be a good starting point and is some food for thought, it is not a recommendation.

Holding gold and silver is to possess real money as insurance and a store of wealth. The equities are to create returns that could beat comparative returns in the market.

Real estate can provide income, capital appreciation and a place to live, but should be viewed as a consumer good.

Alternative investments like watches, fine art, wine, whisky, vintage cars and vintage guitars offer diversification and fun.

Holding cash in the form of fiat currency gives you the opportunity to buy assets quickly but will also be subject to currency debasement at the rate of consumer price increases. You could consider holding cash as paying a premium for optionality.

You can also spend money to insure against potential losses in the market, this is usually called a hedge. You can consider owning gold and silver as a hedge but you can also use market instruments such as options contracts.

For this scenario I currently have a hedge position in place using options to protect against a fall in the Nasdaq 100 index.

A fall in the Nasdaq could potentially bring my positions in Non-Nasdaq/tech related equities down with it (mainly gold and silver miners) due to investors needing to rebalance their portfolios due to margin calls and the need for liquidity.

This hedge is a bear put spread on QQQ (Invesco QQQ Trust Series I), which is an ETF that tracks the Nasdaq 100 index. The position is currently 2.5% of my portfolio but I am planning to increase it to 5%. The position is long dated and expires on 21 January 2028.

To put it simply, if the Nasdaq falls or crashes, the bear put spread position will become more valuable and I can choose to sell it back into the market at a profit to close my position or hold it until expiry.

This position will possibly offset any potential losses in my other positions in the event of a crash.

It is essentially purchasing insurance for my portfolio alongside precious metals and it will cost you money to buy this ‘insurance’ if you decide to do the same.

Sectors

I see near and long term potential in sectors such as precious metals mining, oil and gas equipment and services, uranium, shipping and value companies in emerging markets.

Companies that are producing things that are real, tangible and highly useful to the world.

Energy as a broad theme is likely to benefit as increased demand for AI processing and infrastructure will require massive amounts of energy not currently available.

I own one company of special interest which has developed a unique cost effective process to manufacture graphene. Graphene is seen as a miracle material which is 200 times stronger than steel, has high electrical conductivity rivalling copper and has superior thermal conductivity ideal for heat dissipation. It can be used in many industries.

The company is HydroGraph Clean Power Inc. (HG.CN).

Precious metals

I recommend owning a percentage of your portfolio in physical gold and silver bullion that you can hold in your hands.

To reduce counter-party risk you can store it yourself at home or on your person as you travel. Or you can use international vaulting services such as Bullionstar in Singapore or Strategic Wealth Preservation in The Cayman Islands. Vaulting services add a layer of counter-party risk and create an additional expense but provide convenience and can reduce political and geographical risk.

You can read my guide to owning gold here which covers all aspects of gold ownership.

You can read my guide to owning silver here which does the same.

Hedge Positions

Bear put spread (put debit spread) options position.

Bought QQQ Put | $400 strike price | Expiry 21 January 2028 | $13.96USD per contract

Sold QQQ Put | $350 strike price | Expiry 21 January 2028 | $9.17USD per contract

Spread position cost me $4.79 per position (1 bought contract minus 1 sold contract).

Options contracts always involve controlling 100 shares per contract so buying one of these positions costs $479USD. ($4.79 x 100 shares).

The long expiry on this position gives two years of protection.

At any time you can close the position at a profit or a loss. If the Nasdaq rises the position will lose value, if the Nasdaq falls the position will gain value.

The gains in the position are maxxed out at the $350 strike price. If the Nasdaq falls below $350 the position will not become more valuable.

Current Portfolio

The current year to date returns on my total portfolio in Interactive Brokers stands at 31.82% as of 17/11/2025.

This figure does not include returns from my physical precious metals holdings.

Year to date returns on physical gold stands at 55.61%

Year to date returns on physical silver stands at 64.12%

In comparison year to date returns on the S&P 500 are 14.07%

The current portfolio:

The portfolio consists of individual stocks and ETF’s. Some stocks pay dividends and some don’t.

Of special note is GDXY which is an ETF that invests in the same stocks as the GDX VanEck gold miners ETF. It uses various options strategies such as a covered call options strategy to produce income. The income is then distributed to shareholders via dividends. GDXY currently pays a hefty dividend yield of 61.22%. The current share price of 15.63 is currently trading at a −0.08% discount to net asset value (NAV). The NAV of the fund is calculated through the following formula.

Formula: NAV = (Total value of the fund’s assets - Total liabilities) ÷ Number of outstanding shares.

This is considered the intrinsic value of the fund and is what anchors the share price over time.

Below are the ticker symbols of stocks in individual sectors that you can reference in the portfolio table to find the stock name.

Dividend portfolio - BWO, BWLPG, MPCC and GDXY.

Gold and Silver mining individual stocks - WRLG, DEX, AYA, AGI, AEM and ABRA.

Gold and silver mining ETF’s - SGDM, SLVR and GDXY.

Rare earths - MP.

Oil and gas equipment and services - BWO.

Shipping - MPCC, BWLPG.

Earlier this year I was implementing the options wheel strategy when entering and holding stocks.

I would sell puts to enter a position, then if I get assigned on the put (I have to buy the stock at the strike price) I would now sell covered calls on the stock that I now own. This generated considerable options selling income for me when I previously owned and ran the wheel strategy on companies such as Tesla (TSLA) and NuScale Power Corporation (SMR).

You can read more about implementing an options strategy to increase your income in this system newsletter.

In this letter I won’t analyse and provide research of any specific stock, I will attempt to do this in future newsletters. This inaugural letter is to serve as presenting a broad portfolio overview and macro-investing thesis.

Please look into and research the individual positions in the portfolio if you desire.

Back with more soon and thank-you for reading.

-Shernon Hague

P.S

If you are interested in supporting my work feel free to check out my products and affiliate partnerships below.

The High Fidelity Podcaster - Professional audio course for podcasters and creators.

Investment programs and newsletters:

Capitalist Exploits Insider Program $1000 discount link

Capitalist Exploits Insider Newsletter

Gold and silver bullion purchases and vault storage:

I recommend the services of Bullionstar in Singapore and Strategic Wealth Preservation (SWP Cayman) in the Cayman Islands.

Please make sure to save and click the links again if you start an account and do not make a purchase in the same session. In order to receive my affiliate commission, the purchase needs to be made in the same session after clicking the link within your web browser.

Thank-you for your support.

*Not to be construed as financial advice. This newsletter is for informational and entertainment purposes only. Please perform your own research when making financial decisions.

Cover photograph by Shernon Hague | Arashiyama, Kyoto, Japan 2016 | 35mm film

Thanks for writing this, it clarifies a lot. Transparency and helping others achieve freedom are excellent goals. I understand the value of human-generated content. Perhaps AI can still be a tool for amplifying geniune human insights, not just replacing them. Intriguing perspective.